Center’s jointly-proposed legislation was well-received, will be reintroduced in 2023.

If 2020 was a year of unprecedented social challenge, 2021 was the year we collectively embarked on the long road back to a new normal. We know that things will never be exactly as they were before. Virtual video meetings, once a complicated technical undertaking, are now commonplace. Conference calls via telephone seem to have gone the way of the dinosaur. Even the commute to the office seems unlikely to ever be back up to five days a week for most of us.

The gap in homeownership in the U.S. was deliberately created via tools such as racial deed covenants, redlining in mortgage lending and the building of urban freeways through existing minority neighborhoods. Today, while these tools have largely been set aside, their destructive impacts remain. Most impactful is the wealth gap – homeownership builds generational wealth, and today we see the median Black household’s wealth sitting at just 12.7 percent of the median white household’s wealth ($24,100 vs. $189,100 in 2019 according to the Center for American Progress).

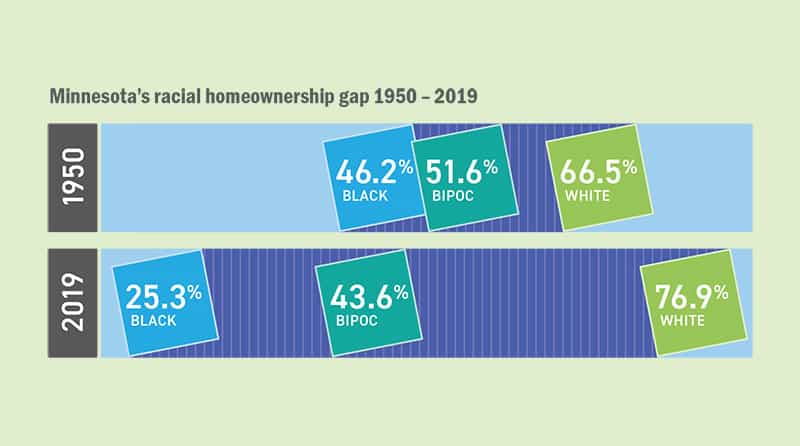

While much has changed, some things have not. With specific relevance for our work, the racial homeownership gap in Minnesota remains one of the highest in the country. And with mortgage rates rising, home prices high and inventory low, the likelihood of seeing any significant movement here without intervention is minimal.

Equitable access to homeownership is critical to our collective social future. And the Minnesota Homeownership Center remains committed to helping bring it about. Toward this end, the Center, Minnesota Realtors® and Twin Cities Habitat for Humanity worked with Minnesota state lawmakers this year to introduce a bill to create a first-generation homebuyer down payment assistance fund. The structure of this proposed fund was crafted with input from a cross section of industry partners.

Targeted and easily accessible assistance for first-generation homebuyers is particularly effective for individuals who do not have access to generational wealth, and ‘but for’ the assistance would not achieve homeownership. Our proposed approach and investment of $170 million would support 5,000 first-generation homebuyers over the next three years, the majority of whom would likely be Black, Indigenous and people of color (BIPOC) due to financial demographics. It’s important to note that, if successful, these 5,000 BIPOC households would move Minnesota from the fifth largest gap in the nation to the 11th – so this would be a start, but certainly not a cure-all. Unfortunately, the bill did not make it into law during the 2022 session. It was largely favorably received, however, and we plan to introduce it again in 2023.